Indonesia is one of Southeast Asia’s fastest-growing gaming markets, driven by a mobile-first population and deep adoption of local digital wallets. For publishers, success in Indonesia depends less on cards and more on enabling the payment methods players already use daily.

In this market, gamers value convenience, speed, and flexibility at checkout. They expect payment experiences that feel familiar, require minimal steps, and work seamlessly on mobile. When friction appears, whether through slow flows, limited options, or unfamiliar methods, conversion drops quickly.

This makes payment strategy a critical lever for publishers deciding how to monetize effectively in Indonesia.

Why Payment Options Matter in the Indonesian Gaming Market

Indonesia has low credit card penetration but exceptionally high usage of:

- E-wallets

- QR-based payments

- Telco billing and bank transfers

Rather than relying on a single dominant payment method, Indonesian players tend to spread their spending across multiple options depending on context such as purchase size, device, or promotional incentives.

For publishers deciding which payment methods to support for Indonesian players, the goal isn’t to offer every option but to cover the right mix that reflects local behavior at scale.

The Most Popular Ways Indonesian Gamers Pay

Looking at transaction activity processed through Codapay, clear patterns emerge around how players choose to complete purchases in games. The table below highlights the most commonly used payment channels in Indonesia and the role each plays.

| Payment method | usage | why it matters to publishers |

|---|---|---|

| QRIS | Very High | Widely adopted national QR standard with over 2.5B transactions per quarter; enables fast, mobile-first payments across multiple wallet and bank apps. |

| DANA | Very High | One of Indonesia’s most trusted e-wallets with 46M users monthly; frequently used for digital content and in-game purchases. |

| Go-pay | High | Part of the Gojek super app ecosystem; integration across transportation, food delivery, e-commerce, and financial services. |

| OVO | High | Strong adoption among urban and repeat spenders. |

| ShopeePay | Medium | Benefits from e-commerce ecosystem usage and promotional incentives that drive more spend. |

| Direct Carrier Billing (XL) | Medium | Reaches users without wallets or bank access; effective for lower-value, in-game purchases. |

| Local Bank Transfers | Low-Medium | Still relevant for specific segments, especially for higher-value transactions. |

Key Takeaways for Publishers

- No single payment method captures the entire gaming audience.

- High-usage methods drive volume, while mid-tier options can expand reach and reduce drop-off.

- Supporting a balanced mix of wallets, QR payments, and alternative methods helps capture both core and edge segments.

This layered approach to payment reflects how Indonesian gamers actually transact, choosing flexibility over uniformity.

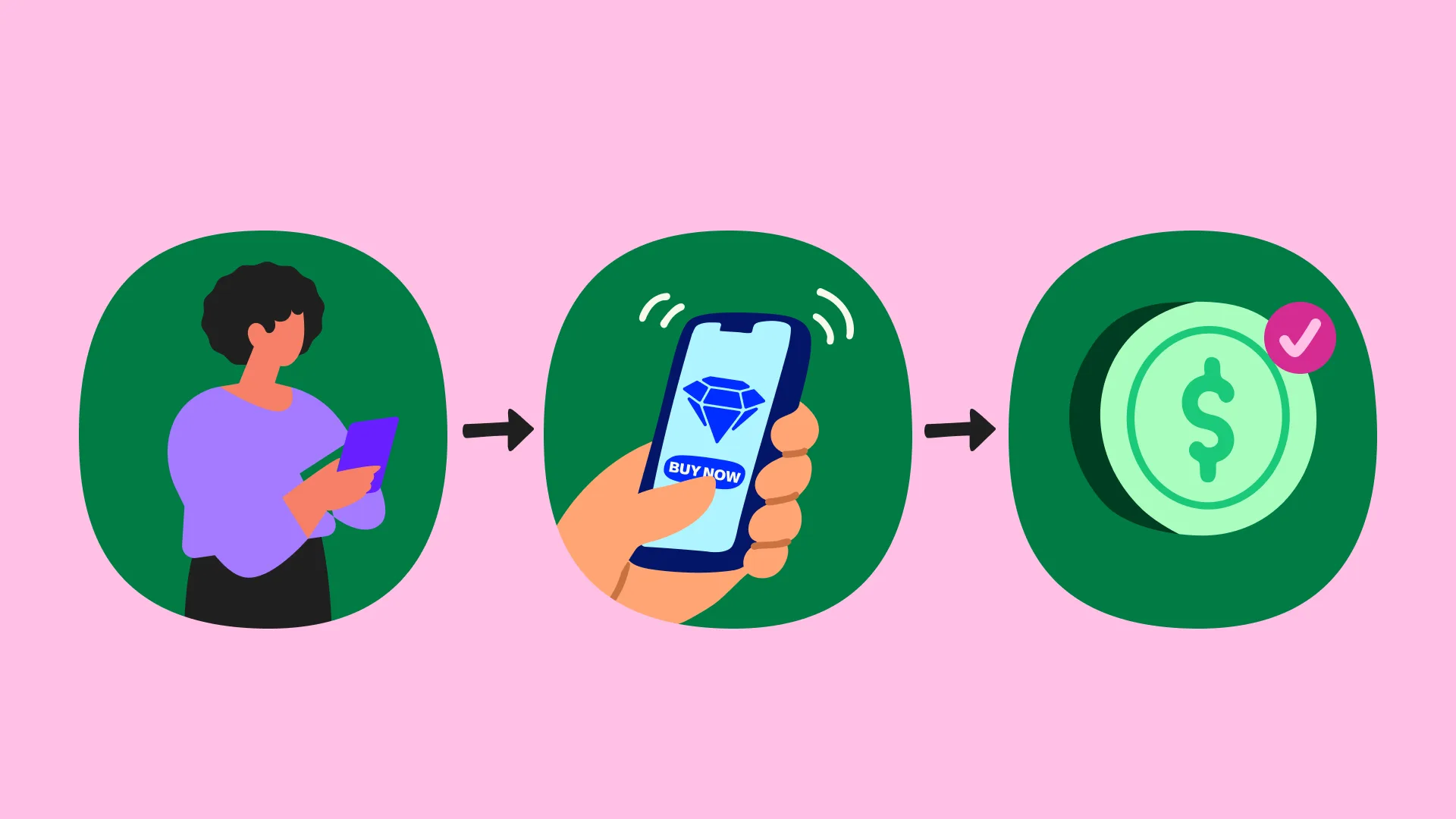

How Coda Enables Local Payment Success in Indonesia

Codapay gives publishers a single integration to unlock Indonesia’s most important payment channels, including QRIS, leading e-wallets, carrier billing, and more, without managing fragmented provider relationships.

Beyond access, Coda also manages local compliance and settlement as Merchant of Record (MoR), allowing publishers to scale across Southeast Asia and beyond without re-integrating.

This means publishers can focus on player experience and growth while Coda handles the operational and regulatory complexity behind the scenes.

Final Thoughts

The gaming scene in Indonesia rewards publishers who adapt to local payment behaviour best. By partnering with Coda and supporting the right mix of wallets, QR payments, and alternative methods, publishers can unlock better conversion, broader reach, and sustainable growth in one of Asia’s most important gaming markets.

Ready to scale in Indonesia? Start here.

© 2026 Coda Payments Pte. Ltd

Site Credits