Table of Contents

- Introduction

- What is a Merchant of Record (MoR)?

- Why Merchant of Record Matters in Gaming

- Unlocking Global Game & App Revenue with Merchant of Record

- Actionable Checklist: How to Choose the Best MoR for Your Business

- Why Choose Coda as Your MoR?

- Scale Seamlessly Across Borders with Merchant of Record

- Merchant of Record FAQs

Introduction

The global gaming industry is on a trajectory to reach USD 236.9 billion by 2025, fueled by premium content and a surge in players across emerging markets like LATAM, SEA, and Africa. (techstartups.com, g-mnews.com) But as demand scales, so does complexity.

The challenge? Expansive growth brings complex challenges:

- Cross-border payments: Managing diverse payment methods and currencies.

- Fraud risks: Evolving tactics threaten revenue and user trust.

- Compliance headaches: Navigating VAT, GST, and regional regulations.

This is where a Merchant of Record (MoR) comes in.

What is a Merchant of Record (MoR)?

A Merchant of Record (MoR) is a legal entity that takes full responsibility for your payment transactions, from processing payments, managing taxes, ensuring compliance, and handling refunds and chargebacks. An MoR assumes the legal and financial responsibilities that come with selling digital goods and services globally, freeing you to focus on what you do best: creating incredible digital experiences.

MoR Key Functions

- Tax Handling: Calculates, collects, and remits sales taxes (e.g., VAT, GST) in various jurisdictions.

- Compliance: Ensures adherence to financial regulations and standards like PCI DSS.

- Payment Settlement: Manages the collection and disbursement of funds from customers.

- Fraud Mitigation: Implements measures to detect and prevent fraudulent transactions.

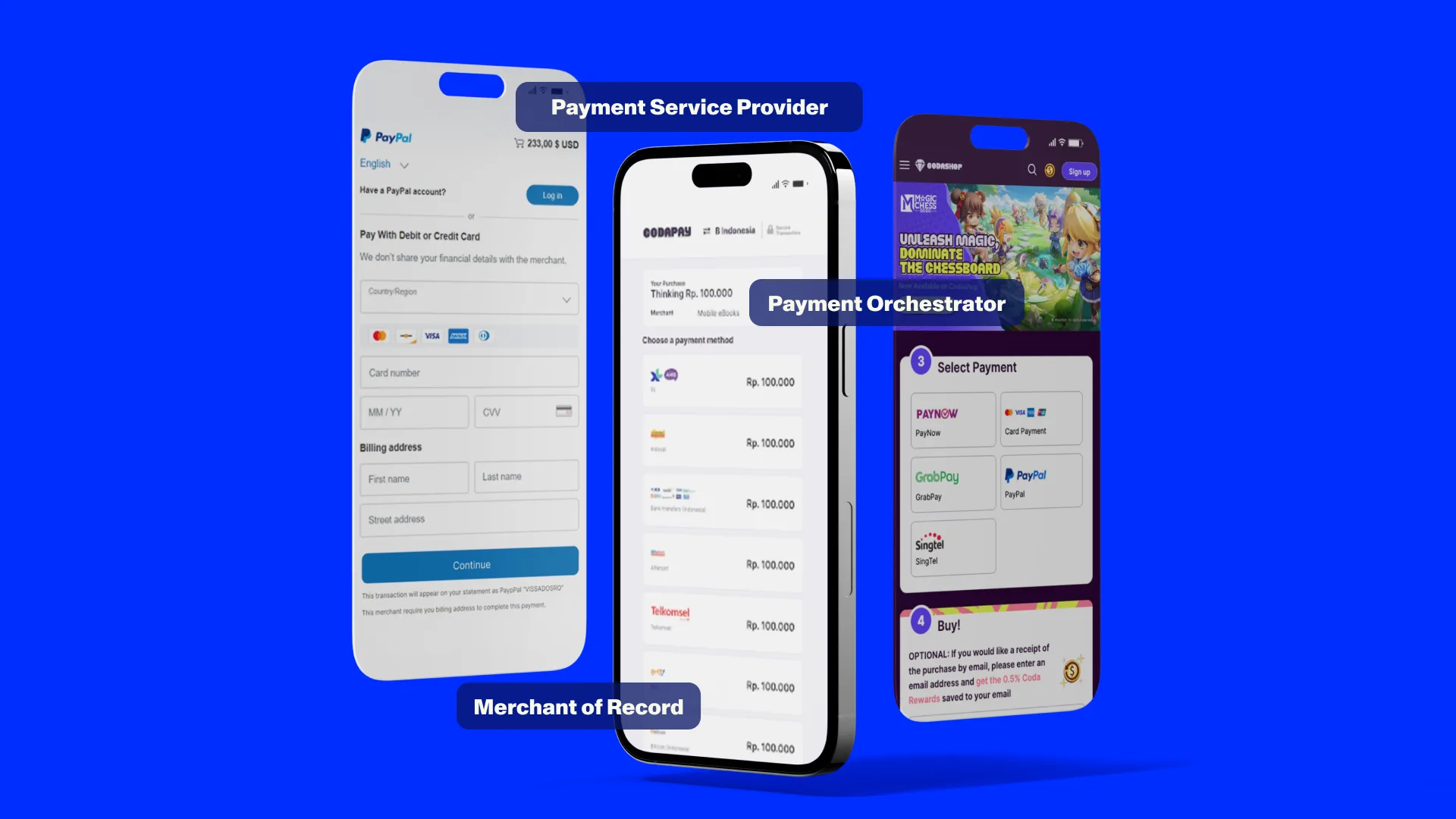

Unlike Payment Service Providers (PSPs), Payment Gateways, or Payment Orchestrators (POs), an MoR doesn’t just facilitate transactions; it owns the responsibility that comes with them, including legal and financial liabilities.

MoR vs PSP, Payment Gateway, PO, Seller of Record

| Feature | MoR | PSP | Payment Gateway | PO | Seller of Record |

|---|---|---|---|---|---|

| Legal Responsibility | ✅ | ❌ | ❌ | ❌ | ✅ |

| Tax Compliance | ✅ | Partial | ❌ | ❌ | ✅ |

| Payment Processing | ✅ | ✅ | ✅ | ✅ | ✅ |

| Refunds & Chargebacks | ✅ | Partial | ❌ | ❌ | ✅ |

| Fraud Management | ✅ | Partial | ❌ | ❌ | ✅ |

The difference? Full responsibility versus partial support. When you’re expanding globally, especially in the complex world of gaming or entertainment space, that distinction matters.

Why Merchant of Record Matters in Gaming

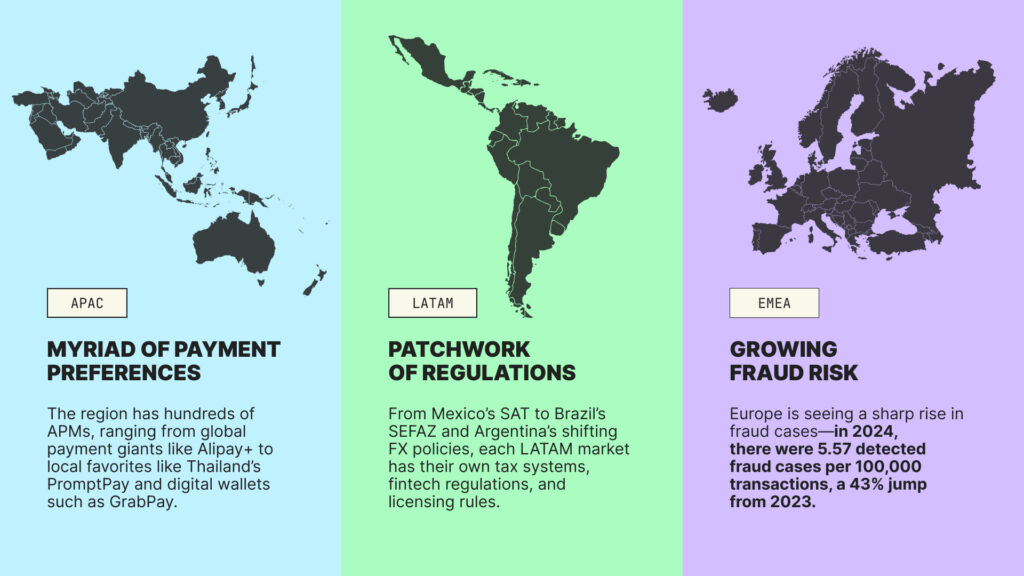

Gaming and entertainment platforms face unique monetization hurdles across regions:

Cross-border payments and currency complexity

Scaling in APAC, LATAM, and EMEA means managing local payment habits, currency conversions, and regional tax rules. Each market comes with its own preferred payment methods. A Merchant of Record takes care of this complexity, so your players can pay the way they prefer, and you can operate seamlessly worldwide.

Protecting revenue from fraud

Gaming platforms are high-frequency environments with global exposure, making them prime targets for AI-driven fraud and identity theft. An MoR uses advanced detection systems to flag suspicious activity, reduce chargebacks, and protect revenue so you can build trust while staying focused on growth.

Staying ahead of compliance

Tax and regulatory frameworks vary widely—from VAT in Europe to GST in Asia. These aren’t optional; they’re legal requirements that can impact your business continuity. An MoR keeps you compliant across jurisdictions, minimizing risk and avoiding penalties.

Optimizing player experience and localization

One-size-fits-all payment flows fall short in today’s global marketplace. Providing a method that aligns with the region’s cultural expectations will enhance user experience and conversion rates. An MoR enables A/B testing and customization of payment processes to align with regional preferences, leading to higher user satisfaction and retention.

Coda’s Expertise

Coda is a trusted Merchant of Record partner for top gaming and digital content brands. Our global footprint spans 65+ markets and 300+ payment methods. We simplify complexity, support rapid scaling, and help partners meet compliance and revenue goals across every region.

Unlocking Global Game & App Revenue with Merchant of Record

Here’s how Coda’s MoR capabilities stack up across key regions:

| Region | Payment Method Coverage | Compliance Expertise | Fraud Prevention | Localization Support |

|---|---|---|---|---|

| APAC | Extensive | Expert | Advanced | Localized |

| LATAM | Broad | Expert | Advanced | Localized |

| EMEA | Broad | Expert | Advanced | Localized |

Out-of-App Monetization & Platform Policy Evolution

The Epic vs. Apple ruling opened new opportunities for revenue outside app stores. Publishers can now offer direct payment options but must ensure legal, tax, and UX compliance across all channels.

This is where a Merchant of Record makes a difference:

- Handles out-of-app payments in a compliant, secure way.

- Helps publishers stay within platform rules while reclaiming margin.

Powers localized web payment flows ready for scale.

Actionable Checklist: How to Choose the Best MoR for Your Business

Before you choose an MoR, ask:

- Global Reach: Can the MoR support your target markets?

- Compliance Expertise: Does the MoR have a strong track record in managing regional regulations in-house?

- Technology Integration: Is their integration simple and scalable?

- Customer Support: Will you retain control of your data and customer experience?

- Cost Structure: Are their fees transparent and aligned with your budget?

See our comprehensive post on 8 essential questions to ask to gain in depth understanding of how to evaluate potential MoR partners effectively.

Why Choose Coda as Your Merchant of Record?

Choosing the right Merchant of Record shapes your global growth trajectory. Here’s why the world’s leading digital entertainment brands partner with Coda:

Trusted by Global Brands

We power monetization for some of the biggest names in gaming and streaming. From mobile gaming giants to social livestreaming platforms, our partners rely on our MoR infrastructure to scale internationally without friction. This makes us the go-to choice for businesses with global ambitions to expand to emerging or mature markets.

Data Ownership & Security

Unlike traditional PSPs or marketplaces, Coda believes your customer data belongs to you. Our platform is designed with data transparency and security at its core. That means you get real-time analytics and full ownership of yourcustomer relationships. Certified under globally recognized standards including PCI-DSS and ISO/IEC 27001, you know your data’s safe with us.

Contract Flexibility

No two businesses are the same. Our commercial models are built for flexibility and scale.

Whether you’re a startup launching in one region or a global platform monetizing over 60+ markets, we adapt to you—your business, your terms. Coda offers tiered pricing, adjustable onboarding paths, and modular services that let you set the pace.

Scale globally with a MoR partner built for growth

Your business needs more than just a payment processor. It needs a strategic partner who simplifies global complexities and accelerates scale for you.

Whether you’re exploring new monetization channels, unifying reporting across regions, or entering high-growth markets in Southeast Asia or Latin America, Coda’s MoR solution moves with you.

👉 Let’s take your game or app global. Talk to us.

Merchant of Record FAQs

What is the difference between Merchant of Record, Payment Service Provider, payment gateway, and others?

Each of these serves different parts of the payment chain. An MoR assumes full legal and financial responsibility for transactions, while PSPs and gateways primarily facilitate processing. Check out our detailed guide on MoR vs PSP vs PO for a full break down of the distinctions.

How is an MoR different from handling payments in-house?

Handling payments in-house means juggling tax compliance, fighting fraud, reconciling finances, and managing customer support for refunds/chargebacks. An MoR eliminates these overheads by assuming liability and infrastructure – allowing you to focus on your core business.

How does a Merchant of Record ensure compliance with regional tax laws (like VAT, GST)?

By monitoring jurisdictional changes and handling tax calculation, collection, and remittance on your behalf. That means no guesswork and no risk.

What are the risks of not using an MoR for gaming and streaming businesses?

Risks include:

- Revenue loss from failed payments and fraud

- Regulatory penalties from non-compliance

- Higher operational costs

- Delayed market entry

- Poor user experience due to limited local payment support

How quickly can a Merchant of Record be integrated into existing payment flows?

Coda offers a self-onboarding system and customizable SDKs that allow most partners to go live in a few weeks. Explore integration options here.

What is out-of-app monetization/payments?

It’s selling directly through your web store instead of app stores—so you keep more margin and control. Coda’s MoR makes this easy and compliant. Learn more about out-of-app monetization.

What reporting and analytics does Coda’s MoR provide?

You get real-time dashboards, region-specific tax reports, revenue breakdowns, and customizable data exports to inform your strategy. (Watch this space for a dedicated analytics landing page.)

How does MoR pricing compare to other models?

MoR pricing includes compliance, tax handling, settlement, and fraud protection. It’s often more cost-effective than managing these functions in-house. (Pricing deep-dive coming soon.)

What level of support and integration guidance does Coda provide?

We offer dedicated onboarding managers, 24/7 technical support, and a global team of payment experts to assist with implementation, compliance questions, and performance optimization.

What fraud prevention strategies do MoRs use?

Coda uses AI-driven fraud detection, geo-based velocity checks, transaction pattern analysis, and chargeback mitigation protocols. Read our fraud prevention breakdown here.

© 2026 Coda Payments Pte. Ltd

Site Credits