Maximizing ROI with a Merchant of Record for Gaming Companies

In gaming, return on investment (ROI) isn’t just a number—it’s how business decisions are measured. Every feature launch, ad campaign, or monetization strategy ultimately needs to prove its worth.

Payment infrastructure is no exception. In fact, they’re one of the most business-critical systems a gaming company must get right. When payments fall short—whether it’s from missed preferences, slow compliance, or fraud—it directly cuts into revenue.

Coda’s Merchant of Record (MoR) model goes beyond backend support—it’s a strategic advantage. It delivers measurable ROI across revenue, operations, and market expansion.

Why MoR Is an ROI Multiplier

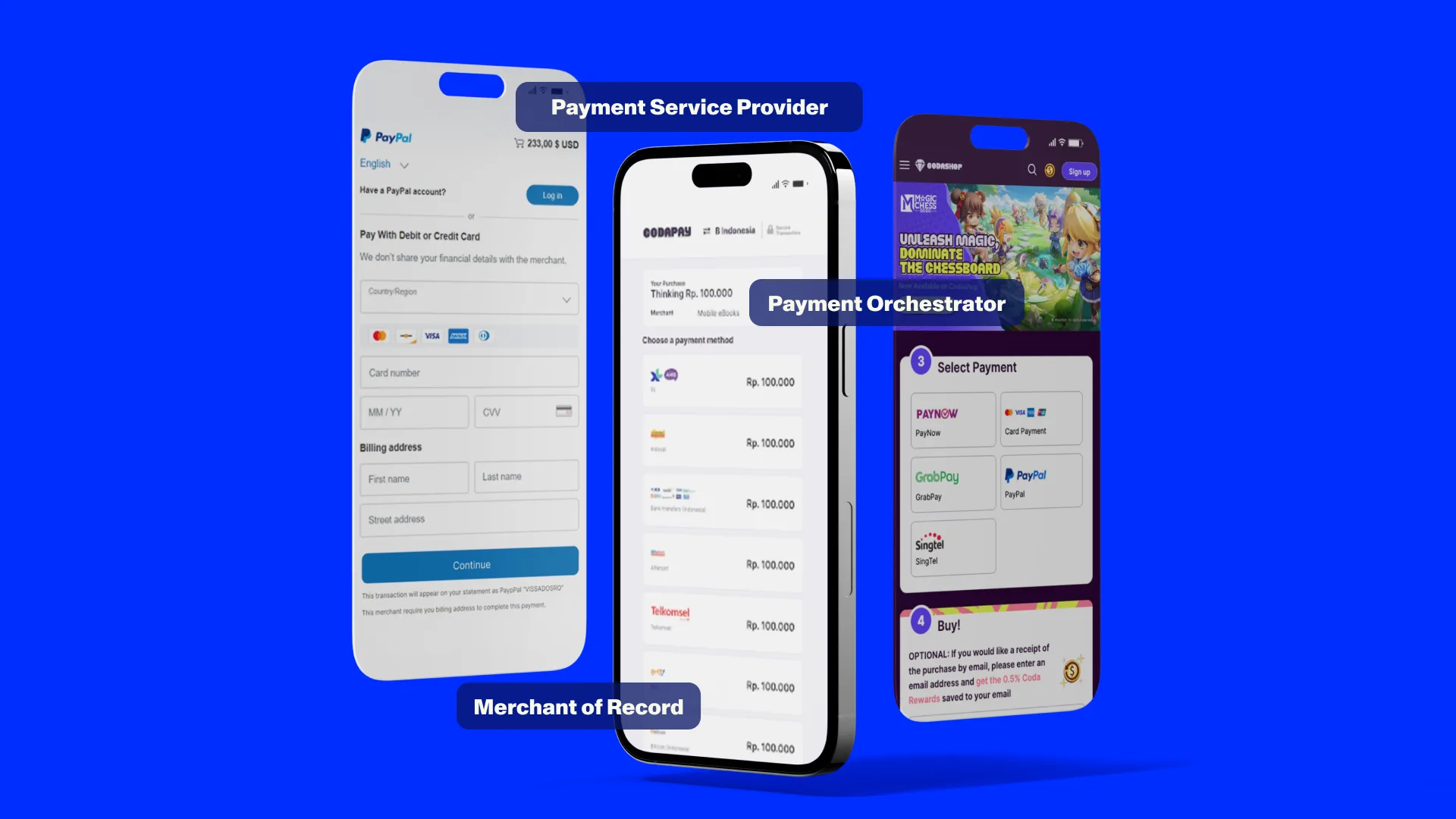

The Merchant of Record model flips the traditional payment model. MoR providers like Coda replace the need for multiple PSPs by managing the full transaction layer—tax, compliance, fraud, settlement, and local payment setup—in one integrated solution.

For gaming companies, a Merchant of Record is more than a simplification—it’s a driver of ROI. It enables:

- Faster entry into high-growth markets

- Lower overhead from outsourced tax and compliance

- Fewer fraud-related losses

- Higher payment conversion rates

- More time for internal teams to focus on growth.

With that in mind, let’s break down MoR’s ROI impact across four business-critical areas.

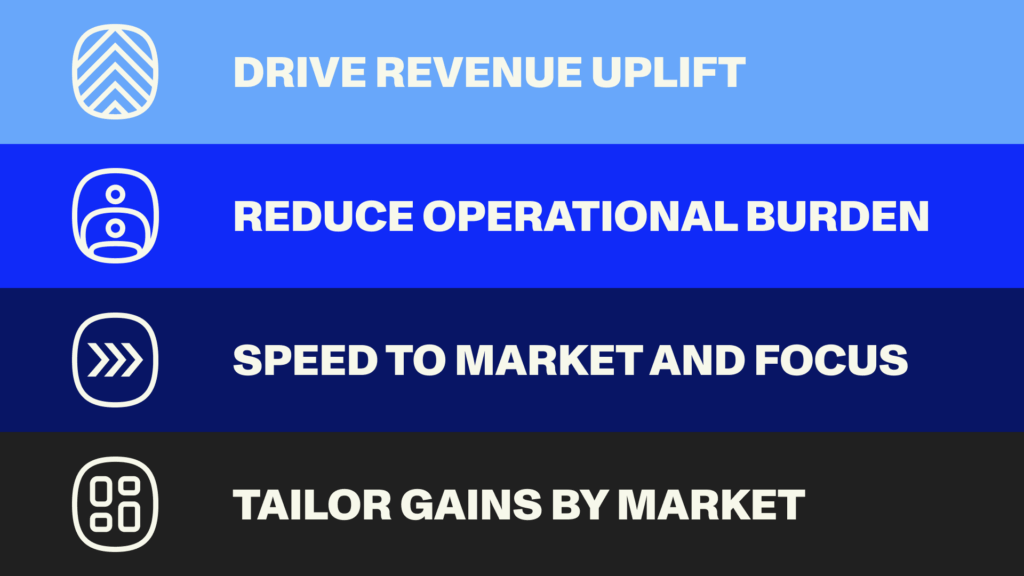

A Goal-Oriented Perspective to Business ROIs

Monetization ROI: Drive Revenue Uplift

MoR drives revenue by enabling local payment methods in key growth markets—like carrier billing in Southeast Asia, cash vouchers in Brazil, and e-wallets in the Middle East. These are not just payment options—they’re essential to reaching entire user segments.

By localizing checkout experiences, MoR providers increase conversions, grow average transaction values, and improve user lifetime value. It’s a direct revenue driver, built for scale.

Operational ROI: Reduce Operational Burdens

Tax remittance, compliance reporting, fraud prevention—these are essential, yet time-consuming tasks.

MoR takes them off your plate. Instead of building out internal legal and finance capabilities in every new market, you inherit a compliant, ready-to-deploy framework.

The result? Faster time to market, fewer internal bottlenecks, and healthier margins without compromising security.

Strategic ROI: Speed to Market and Focus

Without MoR, launching in a new country often means months of setup—PSP integrations, tax filings, legal reviews.

Working with an MoR provider cuts that time dramatically. You go live faster, without tying up internal resources on payment infrastructure. At Coda, we’ve seen partners that go live with us within two weeks.

This enables product and marketing teams to focus on core growth strategies—like content, user acquisition, and retention—instead of backend logistics.

Regional ROI: Tailor Gains by Market

MoR isn’t one-size-fits-all. The ROI you get varies by geography, but the gains are consistently clear.

- APAC: Southeast Asia is a mobile gaming powerhouse, with smartphone penetration nearing 80% and gamers favoring e-wallets and carrier billing over cards. In many markets, wallets like GCash (Philippines), GrabPay (Singapore), and ShopeePay (Indonesia) have become the preferred way to transact online. At the same time, compliance is becoming stricter—Indonesia now requires VAT collection and e-invoicing for digital services. A Merchant of Record handles both local tax requirements and high-performing payment options like carrier billing and QR codes.

- LATAM: Latin America’s gaming market is growing fast, but it’s also one of the most fraud-prone globally, with chargeback and transaction failure rates well above average. Meanwhile, despite rising fintech adoption, cash-based payment options like Boleto (Brazil) and OXXO (Mexico) remain essential for financial inclusion. MoR reduces fraud losses through local partnerships and enables cash-based payment access in markets like Brazil and Mexico.

- MENA: Markets like Egypt, Saudi Arabia, and the UAE pose regulatory challenges—from fragmented rules to currency controls and trade restrictions. Still, gaming revenue is rising fast, fueled by mobile-first users and a young, digital-native population. Yet, gaming revenue is surging—driven by mobile-first behavior and youth demographics. MoR providers navigate country-by-country tax and invoicing mandates, offering localized payment integrations while shielding publishers from legal exposure. The result: smoother launches, stronger compliance, and better UX in a fast-growing region.

- EU/US: Even in mature markets like Europe and the US, MoR drives ROI by simplifying operations and managing tightening regulatory requirements. In the EU, laws like the Digital Services Act and evolving consumer protection rules require more granular reporting, user data transparency, and virtual currency disclosure. In the US, state-level data privacy laws (like California’s CPRA and new rules in Virginia, Texas, and Florida) are creating a fragmented compliance map. Having MoR centralize the management of these burdens and handle them at scale is a strategic advantage.

Cost Breakdown Comparison

Let’s talk numbers. A typical PSP model may advertise 2.9% + $0.30 per transaction. At a glance, it’s the most cost-effective option but that’s just the surface.

| Cost Type | Traditional PSP | MoR (Coda) |

|---|---|---|

| Processing Fee | 2.9% + $0.30 | ~3-4% (all-in) |

| Tax Registration & Remittance | ❌ | ✅ |

| Fraud Liability | ❌ | ✅ |

| Integration Time | 4–6 months | <2 months |

| Local APM Setup | ❌ | ✅ |

Hidden Costs Avoided with MoR:

- No separate tax advisory or legal fees.

- No need for in-house fraud systems.

- Faster time to revenue in new markets.

Frequently Asked Questions

Data Ownership — Will we lose access to customer insights?

Not with modern MoRs. Providers like Coda share granular, anonymized transaction insights. You maintain strategic visibility without managing the heavy lifting.

Control and customization — Are we giving up operational control?

MoR handles execution, not your strategy. You still control pricing, promotions, customer journeys, and UX. APIs and dashboards remain fully configurable.

Contract lock-in — Are we locked into one vendor globally?

MoRs today offer modular, hybrid engagement models. Want to run MoR in LATAM but use PSPs in EMEA? That’s a choice, not a constraint.

MoR as a Strategic Growth Enabler

Look at ROI holistically—revenue, cost, speed, and focus—and the case for MoR becomes clear.

Gaming companies that adopt the MoR model stay in control—while unlocking stronger monetization, faster market entry, and lower operating costs.

Curious what MoR ROI could look like for you? Let’s connect to see what custom assessment works well around your specific regions, goals, and revenue streams.

© 2026 Coda Payments Pte. Ltd

Site Credits