Merchant of Record Solutions for Global Tax & Compliance: How It Works

Selling digital goods across borders—whether games, software, streaming services, or eBooks—means global tax compliance isn’t optional. It’s essential. The world’s tax authorities are paying close attention to digital businesses, and non-compliance can come with a steep price.

In Europe, for instance, Value-Added Tax (VAT) non-compliance may trigger fines of up to €500,000 or even higher, depending on the jurisdiction and nature of the offense. Add to that the complexity of dozens of local rules, from Japan’s consumption tax on digital services to Brazil’s municipal tax layers, and the challenge becomes clear: digital businesses face a fragmented, high-stakes compliance landscape.

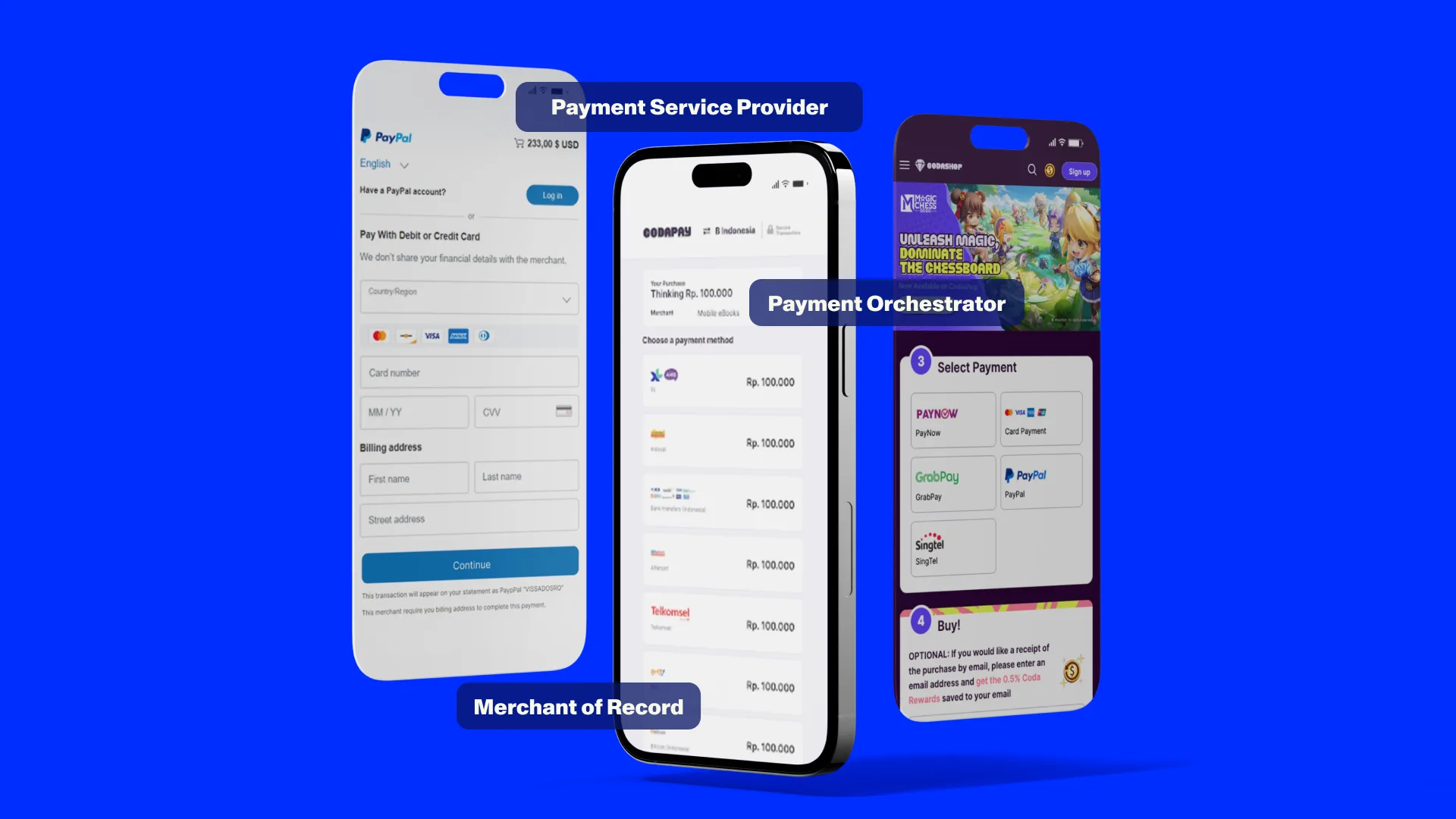

This is where Merchant of Record (MoR) solutions come in. Acting as the authorized seller on your behalf, MoRs take on tax registration, calculation, collection, and remittance. They also handle invoicing, refunds, and customer disputes—freeing you to focus on growth instead of tax codes.

What is a Merchant of Record?

A Merchant of Record is the entity legally responsible for selling your goods or services to end customers. They own the customer relationship from a commercial and regulatory perspective, which includes:

- Registering for taxes where required

- Calculating, collecting, and remitting applicable taxes (e.g., VAT, GST, sales tax, or DST)

- Issuing compliant invoices to end customers

- Managing customer refunds and disputes

- Ensuring compliance with local consumer protection laws

| SOLUTION | Tax registration | tax remittance | compliance liability | refund handling | customer support |

|---|---|---|---|---|---|

| In-House | 👉🏼 | 👉🏼 | 👉🏼 | 👉🏼 | 👉🏼 |

| Outsourced Tax Services | ⏸️ Advice & filing help |

⏸️ May assist |

👉🏼 | 👉🏼 | 👉🏼 |

| Merchant of Record (MoR) | ✅ | ✅ | ✅ | ✅ | ✅ |

A true MoR doesn’t just support compliance—it takes on full legal responsibility, acting as the official intermediary between your business, the end customer, and tax authorities.

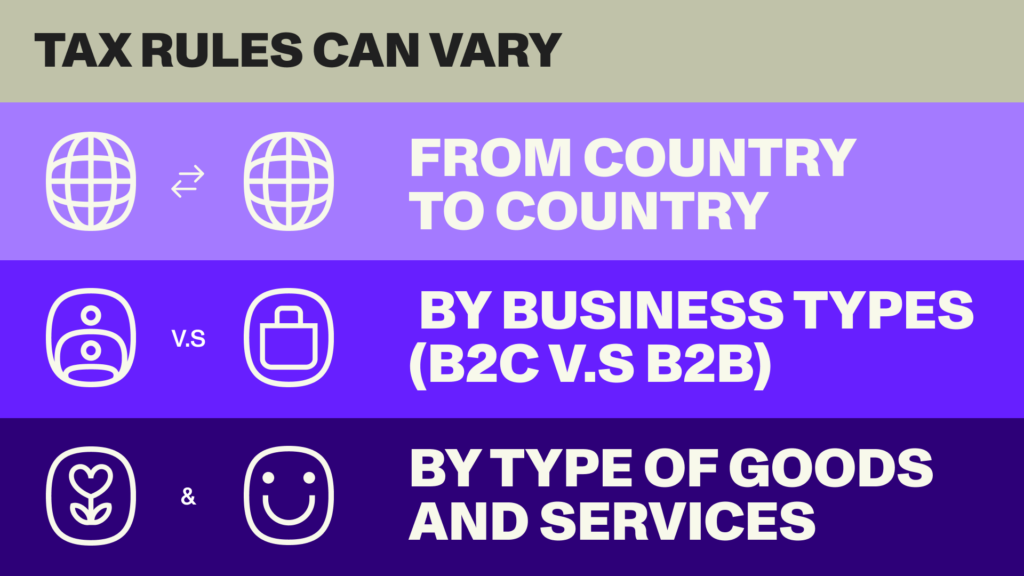

Global Taxation Landscape for Digital Goods

Tax compliance is a complex challenge. Rules differ from country to country–even who you sell to matters. For digital businesses expanding globally, staying current is essential to avoid penalties.

Global Tax Rules Vary–So Do the Risks

A growing number of countries impose a VAT or Goods and Services Tax (GST) for digital goods—even for non-resident sellers. Marketplace tax rules for foreign digital service providers are also emerging in markets such as India, the UK, and Indonesia. In most U.S. states, economic nexus laws require tax collection based on sales activity, not physical presence.

Taxation Exposure: Direct Sales vs. MoRB2C vs. B2B

MoR solutions adapt to both B2C and B2B models. While the core service stays the same, your tax responsibilities—and the value MoR delivers—depend on your customer type and transaction structure.

| Sales model | your tax role | key requirements | mor impact (if applicable) |

|---|---|---|---|

| B2C (Direct Sales) | You are the Merchant of Record | Register for tax in each country where required; apply correct local tax rules and rates; issue compliant invoices | Not applicable — you handle all end-customer tax obligations |

| B2C (via MoR) | MoR is the legal seller | None — the MoR handles tax registration, remittance, and compliance | All end-customer tax obligations are managed by the MoR |

| B2B | You are typically the supplier | Validate customer’s business status (e.g., VAT ID); determine if reverse charge applies | If your B2B buyer is an MoR, they manage downstream customer tax — you focus only on the B2B transaction |

Finer Regional Variations in Digital Goods Treatment

- EU: VAT One Stop Shop (OSS) simplifies multi-country sales within the EU

- Japan: Requires foreign digital service providers to register and charge a 10% consumption tax.

- Brazil: Local municipalities may impose service taxes, layered on top of federal requirements.

Staying Up to Date with Regional Updates & Recent Developments (2021–2025)

North America

- U.S.: Continued enforcement of economic nexus; Alaska and Utah among the latest states to remove minimum transactions threshold in January and July 2025, respectively.

- Canada: GST/Harmonized Sales Tax (HST) applies to nonresident digital platforms and sellers, effective date July 1, 2021.

Europe

- EU VAT in a Digital Age (“ViDA”): ViDA package was adopted on 11 March 2025 with increased focus on real-time transaction reporting through e-invoicing mandates and digital reporting.

- UK: Post-Brexit VAT changes require separate registration; online marketplaces may bear tax liability.

APAC

- Indonesia & India: Tightened enforcement on nonresident digital sellers.

- Japan & South Korea: Clear definitions of electronic services.

- Malaysia: Mandatory e-invoicing implementation for Malaysian businesses starting from August 2024.

- Philippines: 12% VAT enforced on digital services provided by foreign companies with effect from June 2025. Failure to comply may result in suspension of business operations, including blocking of digital services rendered in the Philippines.

Middle East

- GCC VAT: Ongoing rollouts; UAE, Saudi Arabia, Bahrain, and Oman actively taxing digital services.

- Saudi Arabia: Mandatory e-invoicing implementation on all B2B and B2C transactions since January 2023.

Latin America

- Mexico, Colombia, Argentina, Peru: Aggressive enforcement of DST-like rules for foreign platforms.

Staying Ahead: How Coda Maintains Global Tax Compliance

Coda doesn’t just react to regulatory changes—we anticipate them. We’re tax registered under the EU VAT OSS scheme to manage obligations across member states, and we hold sales tax licenses across required U.S. states to meet evolving economic nexus rules. In the Philippines, we’re already registered for digital VAT and prepared for the upcoming June 2025 policy changes. Wherever we operate, we design systems to comply with local mandates from day one.

Broader Compliance Considerations (Beyond Tax)

Global compliance isn’t just about tax collection and remittance. These are other important areas a business needs to cover:

- Consumer Protection: Refund policies, mandatory disclosures, and cooling-off periods.

- Data Privacy: GDPR (EU), LGPD (Brazil), PDPA (Singapore), and local standards.

- Payment Security: PCI DSS compliance to handle cardholder data securely.

- Product-specific Compliance: Age verification (COPPA in the U.S., GDPR-K in Korea), loot box regulation and disclosure, gameplay monetization rules (e.g. play-to-win or chance-cased items restrictions), platform-specific requirements for online games.

- Digital Commerce Compliance: Country-specific operational licenses and platform registrations, such as PSE certification in Indonesia, E-Commerce registration in Thailand, and ETBİS registration in Turkey.

Simplify Compliance with an MoR Solution

You are expanding your mobile game across APAC.

Instead of researching VAT rules in Indonesia, GST thresholds in India, and age-gating in Korea, you have an MoR that takes on the heavy lifting for you.

Local tax registration and remittance, issuance of locally compliant invoices, refunds according to regional consumer protection laws, customer support and chargeback management all sorted on your behalf.

Real-World Example from Coda

Coda has a presence in more than 60 countries and is tax registered in various regions, including Indonesia, Thailand, the Philippines, the EU region, and the U.S.

Our customers can launch in multiple countries—no need to manage local tax rules. Compliance is already built in.

More Industry-based Compliance Insights

Some industries require more attention than others.

Gaming: Loot box regulations and in-game purchases, age verification or minor protection, and consumer protection rules around parental controls and refunds.

SaaS: B2B VAT complexities, reverse charge documentation.

Streaming & eBooks: Location-based tax calculation, especially for mobile and subscription-based services.

Social Casino & Dating Apps: Extra scrutiny around virtual currencies and in-app purchases—often treated differently from traditional digital goods.

Stay Prepared: A Quick Compliance Checklist

Unsure of how and where to get started? Here’s your quick-start guide to global compliance:

✅ Identify where you have tax obligations (B2C vs. B2B, local thresholds)

✅ Register for tax where needed—or confirm your MoR covers it

✅ Validate customer business status for B2B transactions

✅ Implement refund and cancellation policies that meet local laws

✅ Secure customer data in line with regional privacy rules

✅ Stay compliant with payment security standards (PCI DSS)

✅ Monitor updates in digital-specific regulations (like age verification and loot boxes)

Frequently Asked Questions

Do I still need to register for tax if I use an MoR?

No—For all sales to the end customers through the MOR, the MoR is the legal seller who will handle tax registration and remittance for you.

Can I choose which markets my MoR covers?

Yes—MoR solutions typically offer flexible coverage based on your target regions.

Does using an MoR reduce my risk of penalties?

Absolutely. The MoR assumes the legal liability for tax compliance where it acts as the seller of record.

Get Global Tax and Compliance Handled with an MoR Partner

Digital tax rules are becoming more complex. Staying compliant doesn’t require a large tax team—it takes the right partner to simplify and scale your operations.

An MoR solution, like Coda, helps you stay compliant, reduce risk, and scale globally without the stress of navigating dozens of tax regimes alone.

Let’s talk about how Coda can help you simplify global tax and compliance—so you can stay focused on growing your business.

© 2026 Coda Payments Pte. Ltd

Site Credits