The Complete Guide to Merchant of Record 2025: Scaling Your Gaming Business to APAC

Words by Jian Kang, Director of Product Marketing

Mar 05 2025

23 mins

In this guide:

- Why APAC and why now?

- What is a Merchant of Record and why it matters in APAC

- Key Challenges for Gaming Companies in APAC

- How Merchants of Record Solutions Enable Growth in APAC

- Case Study: Thriving in APAC with Coda as Your MoR

- From APAC Success to Global Dominance

- Actionable Checklist: How to Choose an MoR for APAC

- Final Thoughts: Why a Merchant of Record is Essential for APAC Growth

Summary

For gaming companies striving to scale, the APAC region presents a unique blend of high-growth potential and operational complexity. With fast-evolving payment systems, tightening regulations, and growing concerns over fraud, navigating these challenges is crucial for success.

In 2025, the role of the Merchant of Record (MoR) has never been more critical as it provides a solution to simplify cross-border transactions, ensure compliance, and drive business growth. This comprehensive guide will show you how MoR services streamline operations in the APAC region—enabling gaming businesses to overcome hurdles, capture new opportunities, and scale efficiently in a rapidly changing market. Through expert insights, real-world case studies, and actionable strategies, you’ll discover how a Merchant of Record can be the key to unlocking your gaming business’s potential in APAC.

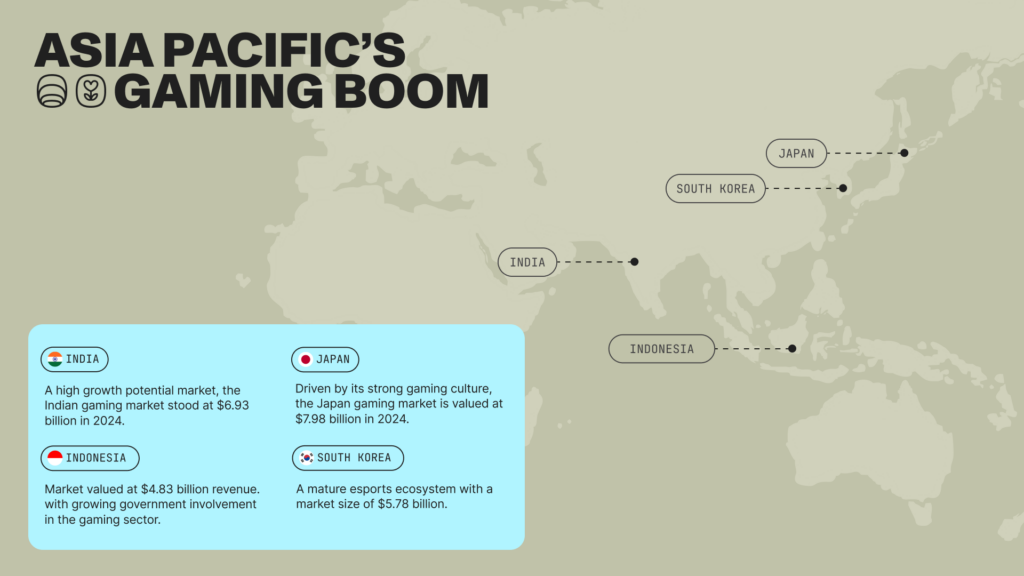

Why APAC and Why Now?

Asia Pacific (APAC) is at the heart of the gaming gold rush. In 2023 alone, the region generated over $84 billion in revenue, with mobile gaming driving much of this growth.

With 1.48 billion gamers across the region, it’s a massive opportunity for publishers.

Even so, breaking into these diverse markets isn’t without challenges. Navigating fragmented payment landscapes, addressing varied consumer preferences, and keeping pace with rapidly evolving regulations present significant hurdles to entry.

This is where the Merchant of Record (MoR) model comes into play. Designed to handle these operational intricacies, an MoR allows publishers to focus on creating great games – not wrestling with compliance and currency issues.

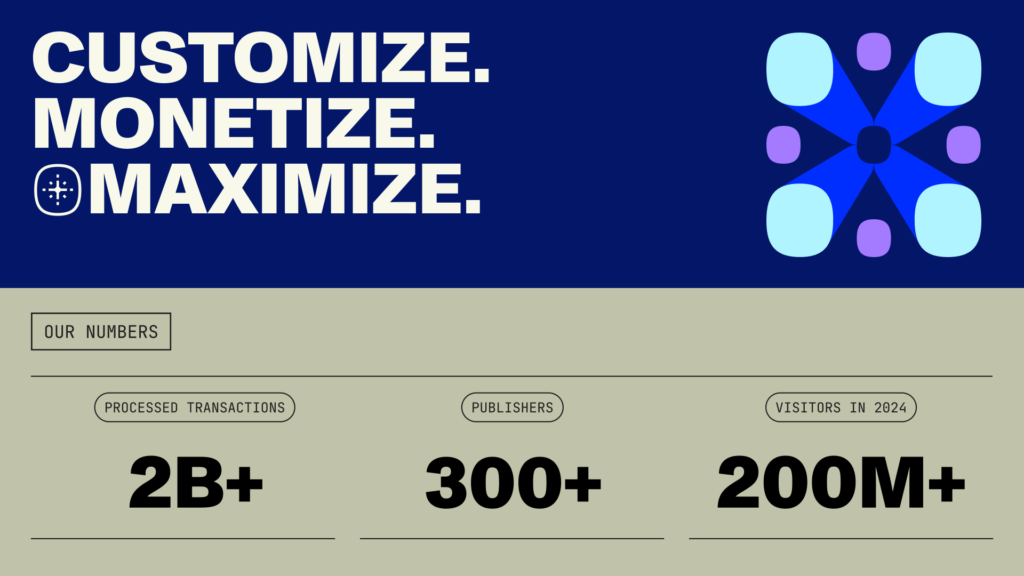

At Coda, we offer our MoR solution as trusted way to fast track global expansion. We manage everything from regulatory compliance and tax obligations to payment processing and fraud prevention so you don’t have to.

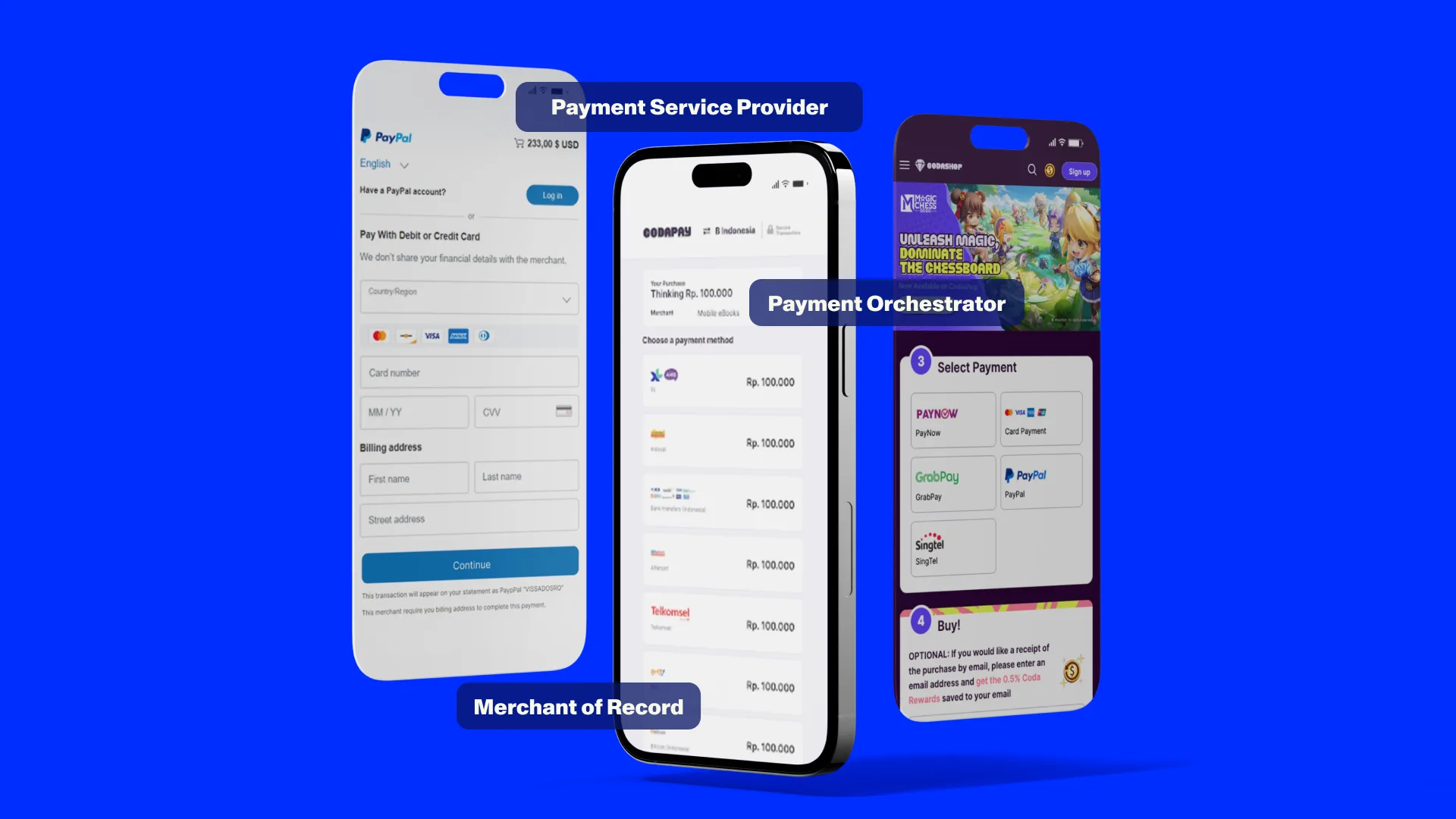

What is a Merchant of Record and Why It Matters in APAC

Merchant of Record (MoR): The legal seller of your digital goods and services, taking on full responsibility for processing payments.

This includes managing compliance, tax calculations, fraud prevention, and customer service – crucial functions that allow publishers to focus on creating exceptional games without getting entangled in operational complexities.

Common Pitfalls of an In-House Approach

While managing payments in-house may seem like a cost-effective solution, it often introduces unforeseen complications that can hinder business growth. Here are the most common challenges publishers face without an MoR partner:

- Higher total cost of ownership: Handling payments internally involves multiple third-party integrations, compliance audits, and significant team hours. Vendor fees, tax consultancy services, and continuous tech support can quickly exceed initial budget estimates.

- Opportunity cost: Every hour spent on payment logistics is time lost on core activities like game development, marketing, and community engagement. Diverted focus slows product iterations and hampers revenue growth.

- Operational complexity & compliance risks: Navigating local tax laws, currency regulations, and preferred payment methods in APAC’s rapidly evolving regulatory environment is intricate. Falling behind on compliance can lead to hefty fines or market bans.

- Resource drain: Building and maintaining a comprehensive payment stack – with features like digital wallets, Buy Now Pay Later (BNPL) solutions, and local bank transfers – demands considerable development hours and compliance resources.

Bottom line: Let an MoR handle the headaches while you focus on creating amazing games.

Why an MoR is a trusted way to fast track Global Expansion

The MoR model isn’t just about streamlining payments – it’s about unlocking safe and efficient global expansion. This is how:

- Full regulatory compliance: APAC’s regulatory landscape changes rapidly. An MoR ensures you stay compliant with local laws – from Indonesia’s evolving gaming regulations to the Philippines’ new licensing requirement for merchant payment acceptance – so you never miss critical updates.

- Effortless tax compliance: From VAT to GST, an MoR calculates, remits, and reports taxes, ensuring full compliance across regions.

- Comprehensive global payments coverage: Unlock new audiences and boost conversion rates by helping users pay how they please. For example, Coda’s MoR solution unlocks access to 400+ local payment methods across 70 countries.

- Fraud prevention: Bypass traditional processing and use advanced tools to block bad actors – minimizing refunds and chargebacks from dissolving more of your bottom line.

- On-the-go scaling: As your user base grows, so do your transactions. An MoR model is equipped to deal with fluctuations in demand, scaling easily to meet your business needs at every step of its journey.

- Take charge of your monetization model: An MoR allows you to bypass app store fees – which can reach up to 30% – and implement direct payment options that improve margins and strengthen customer relationships.

We talked about how the APAC gaming scene is booming. It is a market that’s leading the world in size and growth. Perhaps equally exciting and troublesome, each country in APAC is its own unique puzzle piece, with varying payment preferences, consumer behavior, and regulations. The true value of a MoR model lies in its ability to be your end-to-end partner across all your business needs, from handling transactions to compliance and risk–it’s scaling, simplified.

Navigating APAC’s Complex Payment Landscape

APAC is the largest and fastest-growing gaming market, but its diversity creates unique operational hurdles. Earlier, we mentioned that each country presents a unique set of payment preferences, consumer behaviors, and regulations – turning market entry into a complex puzzle.

Regulatory Shifts and Currency Hurdles

Take Indonesia as an example. In 2024, the government introduced Presidential Regulation 19/2024 and Regulation 2/2024, establishing a national gaming industry roadmap and updating age classification standards. These measures signal a broader trend across APAC: governments are becoming more proactive in shaping the gaming landscape.

Currency management presents another layer of complexity. Many APAC currencies – such as IDR (Indonesian Rupiah), MYR (Malaysian Ringgit), MMK (Myanmar Kyat), PHP (Philippine Peso), and INR (Indian Rupee) – aren’t freely tradable outside their home countries. Without the proper documentation and local partnerships, repatriating earnings in USD can become a logistical nightmare. Companies risk having revenue trapped in local accounts, disrupting cash flow and slowing down operations.

Fraud, Compliance, and Breaking Free from App Store Limits

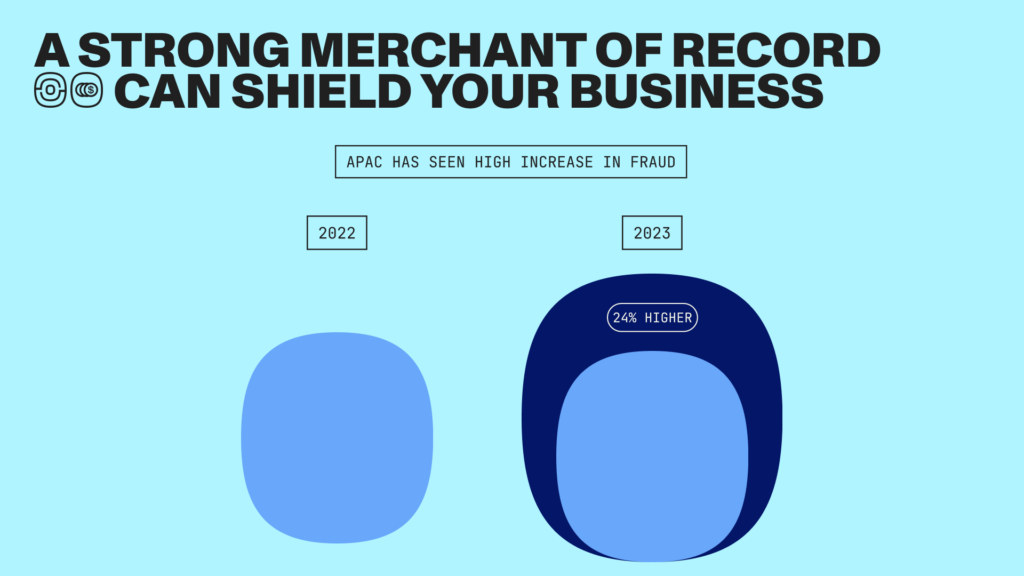

APAC also has one of the highest fraud rates among all regions, surging by 24% from 2022 to 2023. Being adequately protected by a strong MoR shields your business from fraudsters and reputational damage. In markets with a cultural emphasis on trust, being protected against fraud isn’t just operationally smart – it’s essential for brand reputation.

Beyond keeping pace with regulatory developments and compliance, an MoR model is crucial in APAC to simplify your growth outside of app stores. Handling payment regulations and cross-border compliance can feel like a maze. Don’t let them slow you down—focus on building great games while an MoR clears the path.

Key Challenges for Gaming Companies in APAC

Asia Pacific (APAC) is a top expansion target for many publishers – and for good reason. With its diverse markets and deep-seated passion for gaming, the region presents significant growth potential.

APAC gamers spend more hours in virtual worlds than players in other regions, and notable milestones—like esports debuting as an official medal event at the 2023 Asian Games in Hangzhou—underscore the region’s rising prominence.

Yet, publishers face multiple roadblocks when breaking into APAC. Let’s go into detail on what you’re up against:

Challenge 1: Alternative Payment Methods Dominate the Field; Credit Cards Take a Backseat

In Western markets, credit cards dominate digital payments. In contrast, APAC is mobile-first. Over 70% of Southeast Asian consumers are unbanked or underbanked. With one of the highest rates of mobile phone penetration globally, mobile banking platforms have become a natural extension of daily life.

Most users juggle multiple digital wallets, making payment flexibility critical. Here are some of the most popular alternative payment methods (APMs) in APAC:

- GrabPay: Widely used across Singapore, Malaysia, Philippines, Thailand, and Indonesia, GrabPay has become a dominant force in the region’s digital payments landscape.

- Dana: Indonesia’s homegrown e-wallet, boasting 180 million users in 2024 – a significant portion of the country’s 275 million population.

- GCash: The Philippines’ leading fintech app with 94 million users, representing 94% of the market’s fintech app user base.

- Touch ‘n Go: Malaysia’s top e-wallet, preferred by 62% of Malaysians in recent surveys.

- Alipay & WeChat Pay: Dominating China’s payment landscape, these platforms extend their reach to even serve Chinese tourists globally.

Is this the moment to break away from traditional app stores and maximize margins? There’s never been a better time to take control—an MoR model makes it possible. You can tap into local payment methods seamlessly, no matter the commerce platform with an established MoR. With Coda’s 400+ payment options, you can access lower fees, more payment options, and higher conversions.

Challenge 2: Navigating the Maze of Cross-Border Payments and Compliance

Expanding across APAC involves tackling a complex web of foreign exchange headaches and compliance challenges:

- Multi-currency payments: Fluctuating exchange rates can erode margins. Some emerging markets also have parallel market FX pricing, making official exchange rates unpredictable.

- Tax complexities: Frequent changes to digital Goods and Services Tax (GST) and Value-Added Tax (VAT) rules require constant monitoring.

- Cross-border settlement: Many popular local payment channels only work with local entities, settling in domestic currencies, due to licensing or operational issues. Without an MoR providing a local entity, a publisher can be prevented from offering the most popular payment methods.

- Regulatory shifts: Indonesia’s recent tightening of gaming regulations and the Philippines’ new licensing requirement for merchant payment acceptance are just two examples of evolving regional oversight.

The Opportunity: An MoR handles tax remittance, FX management, and local compliance, so publishers don’t have to. Publishers can skip the regulatory frameworks and stay 100% compliant—while focusing on growth.

Challenge 3: Protecting Revenue Amid Rising Fraud Rates

We’ve discussed that APAC has some of the highest online payment fraud rates globally. By 2025, the region is expected to lead in fraud losses.

Important note: Fraud methodologies vary across markets, underscoring the need for localized solutions:

- Philippines: Rising phishing attacks target digital wallet users, with fraudsters impersonating gaming platforms to steal credentials.

- Vietnam: Increasing cases of credit card testing fraud are disrupting in-game transactions and eroding user trust.

- Thailand: Phishing and banking scams occur at rates 70% higher than the global average, demanding heightened vigilance.

The Opportunity: With fraud on the rise, safeguarding revenue is non-negotiable. As an MoR, Coda’s approach includes real-time transaction monitoring to detect suspicious activity early, allowing us to detect fraud within minutes and stop it within hours. We also leverage AI-powered fraud scoring that adapts to evolving attack patterns, alongside cross-game fraud detection to block bad actors network-wide.

The result? Less fraud, fewer chargebacks, and higher revenue retention.

Challenge 4: Speed Matters, Fast Payouts Are the Way To Go

With the creator economy thriving, speed matters more than ever. In a world overflowing with content, consumers expect instant gratification. Many are increasingly opting for instant e-wallet payouts over traditional bank transfers to avoid delays.

The Opportunity: Trusted and used by the largest creator economy publishers, Coda as an MoR makes it easy to distribute earnings in real-time through digital wallets and local payout solutions. Many creator economy platforms trust Coda to net off their pay-in funds in currency-restricted markets for payouts, which is made possible only by Coda being the MoR in these markets, such as Indonesia, Egypt, and Pakistan. In addition, speed matters —whether it’s for individual content creators, streamers, game partners, or affiliate marketers—and an MoR ensures payouts happen fast.

How Merchants of Record Solutions Enable Growth in APAC

Growth isn’t just about launching a game and hoping players show up – you need more than just a great product. Seamless payments, recurring revenue models, strong localization, and cross-border enablement are all crucial pieces in scaling strategically.

This is where a Merchant of Record (MoR) makes a real difference.

Unlike standard payment processors, an MoR manages the entire operational process. Beyond handling payments, preventing fraud, and ensuring compliance, the right MoR partner delivers tangible value that fuels revenue growth.

With Coda as your MoR partner, you gain a reliable, scalable solution that enables fast market entry and maximizes revenue potential across APAC. The possibilities are endless:

Unlocking Recurring Revenue with Subscription Models

Subscription-based gaming and in-game content are becoming increasingly popular in APAC as publishers look for predictable, long-term revenue streams.

However, executing an effective subscription strategy goes beyond implementing a simple checkout function. Publishers need to manage:

- Recurring payments to ensure seamless renewals without failed transactions.

- Compliance with auto-renewal regulations, particularly in markets like Japan and South Korea where strict subscription rules apply.

- Flexible payment options to cater to player preferences, with many opting for digital wallets over credit cards.

An MoR helps optimize these processes, providing localized solutions that maintain player engagement while ensuring steady revenue.

Driving Direct Sales with White Label Custom Web Stores

While app stores have long been the default sales channel, they often charge significant platform fees and offer limited control over customer engagement.

Establishing a direct-to-consumer web store offers publishers several advantages:

- Sell directly to players, avoiding platform fees that can sometimes eat into almost a third of your profits.

- Offer exclusive content and promotions tailored to local market preferences

- Increase revenue retention and gain full ownership of customer data.

Working with an MoR like Coda enhances this process further:

- Integrates seamlessly with popular local payment methods including Dana, GrabPay, GCash, and Alipay.

- Supports localized pricing to ensure players transact in their native currencies, such as IDR in Indonesia or THB in Thailand.

- Enables quick and smooth checkout processes to improve conversion rates, leveraging Coda’s web store expertise, which comes from operating Codashop for over a decade and continuously optimizing user experience, conversion, and payment success rates.

By leveraging an MoR’s full-stack payment and compliance support, publishers can launch a high-converting web store, maximize revenue, and reduce reliance on app stores.

Localization Beyond Payments: Tailoring UX for APAC Audiences

Localization extends beyond providing the right payment methods. To build lasting engagement, publishers need to adapt their entire user experience to regional expectations and preferences. Key considerations include:

- Adjusting payment user interfaces to prioritize preferred methods in each market. For example, Vietnamese players expect digital wallets as default, while Japanese gamers often prefer bank transfers.

- Offering comprehensive language support. Full localization is essential in markets like Korea and Japan, whereas English interfaces may suffice in regions like Singapore.

- A/B Testing. Local preferences vary – continuously testing and refining checkout flows can help identify what resonates with users and improve conversion rates. In a recent experiment, we tested automatic redirection in the flow for leading payment channels in SEA, eliminating an extra click in the payment process. This change led to a measurable increase in successful payments and a reduction in payment abandonment. By removing friction, we improved the overall user experience, validating the approach for broader implementation across similar payment flows.

MoRs optimize every touchpoint, ensuring the right user experience and payment flow for every market.

Cross-Border Enablement: Expanding Without Borders

Expanding across APAC presents complex challenges in foreign exchange management, tax compliance, and cross-border transactions.

Without dedicated support, publishers risk operational delays and financial inefficiencies. An MoR solves these through:

- Forex Transactions & Revenue Optimization

- Some APAC markets, like Indonesia and India, have currency controls, making revenue repatriation tricky.

- An MoR simplifies FX management, ensuring publishers receive earnings in their preferred currency without hidden losses.

- Tax Compliance Across APAC

- GST and VAT rules vary in every country.

- Japan, South Korea, and Australia have strict digital tax regulations. An MoR ensures automated compliance and avoids penalties.

- Local Payment Partnerships for Wider Reach

- Many APAC payment providers require local partnerships to operate legally.

- An MoR has established relationships with regional payment networks, unlocking new monetization channels without publishers having to set up a local entity.

Partnerships: Expanding Distribution in APAC

APAC’s gaming ecosystem thrives on partnerships. A well-connected MoR like Coda can help publishers unlock valuable regional networks, improving reach and engagement.

MoR-supported partnership opportunities include:

- Game distribution: Distribution collaborations with established local publishers, critical in markets like Indonesia, Vietnam, and Thailand.

- Co-marketing: Local partnerships can extend your reach to more users. In 2024, Coda ran 100+ co-marketing campaigns with payment channels (PC), securing nearly a million in co-funding and driving multifold total payment volume (TPV) attributed to PC co-funded campaigns.

- Exclusive Payment Deals: Through global payment partnerships, we offer exclusive discounts, cashback and loyalty rewards to engage publisher audiences. Payment channels collaborate with Coda, providing value props and marketing support, driving an up to 50% TPV uplift for partnership campaigns in 2024. Key partners include GCash, GoPay, CelcomDigi, TrueMoney Wallet, Pix, and more.

By leveraging an MoR’s ecosystem, publishers can tap into APAC’s massive player base and scale faster.

In Short, Scale Smarter with an MoR

Scaling in APAC is filled with opportunities – but also complex challenges. From navigating regulatory requirements to optimizing local payment preferences, succeeding in the region demands more than a one-size-fits-all approach.

With Coda as your MoR partner, you gain a comprehensive solution that removes operational hurdles, streamlines compliance, and maximizes revenue potential. Together, we help you work smart so you can keep building great games.

Case Study: Thriving in APAC with Coda as Your MoR

How one top-tier game publisher scaled faster, reduced costs, and unlocked new markets with Coda’s Merchant of Record model.

The Challenge: Navigating A Complex APAC Market

A leading global game publisher set out to expand aggressively across the Asia Pacific (APAC) region. Despite the vast market potential, the company faced three significant hurdles that impeded its growth strategy:

- High Platform Fees: App stores were taking up to a 30% commission on in-app purchases, significantly reducing profit margins.

- Payment and Compliance Challenges: Many APAC markets required integration with local payment methods and adherence to complex tax regulations, areas where the publisher lacked regional expertise.

- Fraud and Chargebacks: Rapid scaling led to an increase in fraudulent transactions and disputed payments, threatening both revenue and player trust.

The publisher needed a solution that would enable them to localize payments, ensure compliance, and improve revenue without adding operational burdens.

The Solution: Coda’s MoR Model

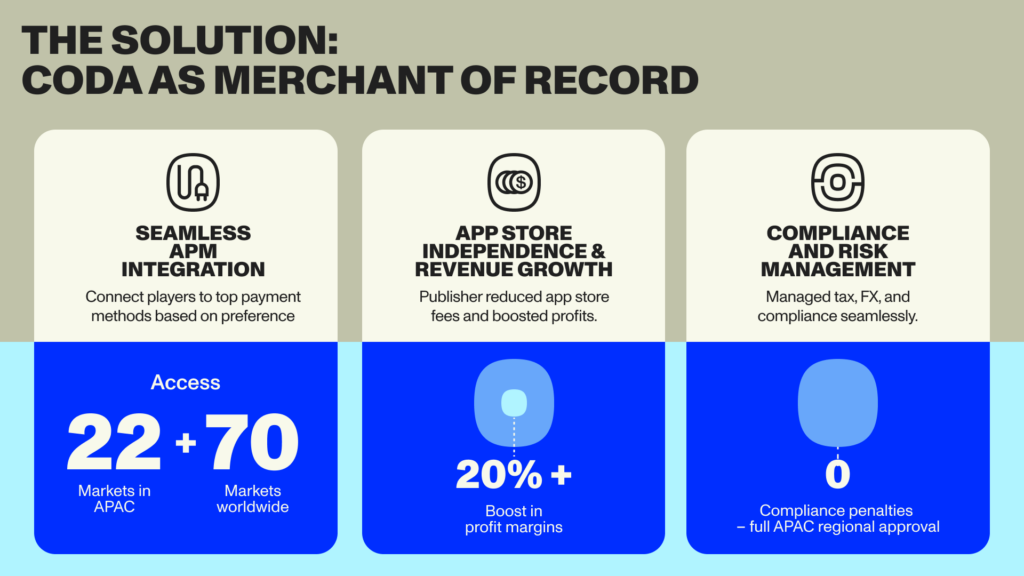

By partnering with Coda as their MoR, the publisher gained:

Seamless APM Integration

Coda enabled integration with the region’s most popular payment methods, including Dana, GCash, GrabPay, and Alipay. This gave players access to their preferred payment options, resulting in:

- Market-leading web store transaction success rates.

- A significant reduction in checkout abandonment rates.

App Store Independence & Revenue Growth

With direct APM payments facilitated by Coda, the publisher minimized reliance on app stores, reducing transaction-related fees and improving profit margins. The outcome:

- 15% increase in net revenue through direct sales channels.

- Improved pricing flexibility.

Compliance & Risk Management

Coda handled tax remittance, cross-border FX conversions, and local regulatory compliance seamlessly, resulting in:

- Zero compliance penalties and full regional approval across all APAC markets.

- Full adherence to local tax laws, including GST and VAT obligation

Fraud Prevention at Scale

As transaction volumes grew, so did exposure to fraud. Coda’s AI-driven fraud detection systems provided real-time transaction monitoring and adaptive fraud scoring, leading to:

- Reduction in chargeback losses.

- Strengthened player trust and facilitated smoother payment experiences.

The Results: A Winning Strategy For APAC

With Coda’s MoR model, the publisher was able to achieve the following milestones within the first 3 months of the partnership:

- Entered 10+ APAC markets without the need for local subsidiaries.

- Increased payment success rates, improving conversion and player satisfaction.

- Converted more players into payers by bringing double-digit growth in Net New Buyers.

- Saved millions in platform fees by bypassing app store commissions.

- Rapid scaling to additional regions such as LatAm and Africa while maintaining operational efficiency.

Coda’s Merchant of Record solution provided this top-tier publisher with the tools to overcome these hurdles, enabling faster market entry, improved profitability, and a better player experience.

From APAC Success to Global Dominance

Success in APAC isn’t just about conquering one of the fastest-growing gaming markets – it’s a launchpad for global expansion. With the right MoR partner, publishers can seamlessly scale from APAC to LATAM, EMEA, and beyond, minimizing friction while maximizing revenue.

What does it take to win in APAC? The same essentials for success in LATAM and EMEA—mastering APMs, regulatory compliance, and cross-border transactions.

What works in APAC can work globally. The key lies in choosing a scalable MoR solution that adapts to regional payment preferences, tax structures, and compliance landscapes. By leveraging proven strategies from APAC, publishers can turn regional success into a global blueprint, accelerating growth with minimal disruption.

Coda’s MoR model is designed for scale – making global expansion easier, faster, and more profitable. Here’s how:

Crossing Borders Seamlessly

Expanding into new markets doesn’t require reinventing the wheel. By applying successful APAC strategies, publishers can adapt quickly with minor adjustments:

LATAM: Tapping into Region-Specific Payment Preferences

Markets like Brazil, Mexico, and Argentina rely heavily on localized APMs such as PIX, OXXO, and Boleto Bancário. These methods mirror the popularity of DANA, GCash, and GrabPay in APAC. With Coda’s MoR solution, integrating popular regional payment methods is simple and efficient.

EMEA: Navigating Complex Regulations with Confidence

Markets like Turkey, Egypt, and Saudi Arabia have intricate tax laws and FX regulations – similar to APAC markets. Tax laws and FX are heavily influenced by politics and general countries’ economy. For example in Turkey, following months of budget deficits due to election spending and relief for natural disasters, the Turkish government announced a VAT increase from 18% to 20% on a Friday, 7th July 2023 with immediate effect the following Monday, leaving companies scrambling to implement the changes on time to avoid non-compliance.

Backed by extensive regional experience, Coda’s MoR assures smooth compliance with local financial regulations, even through sudden regulatory changes, so you can enter high-complexity markets with confidence.

Conquering Compliance & Tax Management with Ease

Global operations often come with significant legal overhead. Coda’s MoR model simplifies compliance and tax management, eliminating the need for publishers to set up local legal entities in each country, retain regional tax experts for every market, and navigate complex reporting requirements alone.

As the legal seller of record, Coda handles the heavy lifting, enabling publishers to reduce administrative burden and focus on revenue-driving activities.

Scalability Without the Operational Overhead

Scaling globally doesn’t have to be complicated. With Coda’s MoR solution, publishers can achieve:

- Multi-region coverage through a single integration: No need for fragmented payment solutions or multiple vendor contracts.

- Simplified financial reconciliation: Streamline back-end processes for faster settlements.

- AI-driven fraud prevention: Secure transactions across all regions while minimizing chargebacks and safeguarding player trust.

Choosing Coda means focusing on what you do best – creating and publishing exceptional games – while we handle the complexities of global commerce.

Actionable Checklist: How to Choose an MoR for APAC

Choosing the right Merchant of Record (MoR) isn’t just about handling payments – it’s about enabling long-term growth, maximizing revenue, and ensuring operational efficiency across APAC’s complex and varied markets.

The right partner should not only simplify transactions but also navigate the regulatory, technological, and market-specific nuances that come with operating in the region.

Here’s an actionable checklist to guide your decision-making process.

Coverage of Key Payment Methods

In APAC, consumers favor local methods over global credit cards. E-wallets, direct carrier billing, and bank transfers dominate the market.

- Ensure your MoR supports essential regional methods like GrabPay, Dana, GCash, Alipay, and direct carrier billing solutions.

- Coda’s Strength: Over 100 local payment integrations, enabling frictionless transactions and improving conversion rates across APAC markets.

Cross-Border Compliance & Multi-Currency Transactions

Operating across multiple APAC countries requires navigating varied tax regulations, foreign exchange controls, and remittance requirements. Before you go global, make sure to ask:

- Can the MoR handle regional tax laws, including GST and VAT obligations?

- Confirm your MoR is set up to manage obligations like GST, VAT, and other local requirements.

- Does the provider offer seamless currency conversion and revenue repatriation without hidden fees?

- Ensure it supports multi-currency transactions without hidden fees.

- Coda’s Strength: Full-stack tax compliance and multi-currency payout solutions, no matter the country.

Fraud Prevention Tailored to APAC

Fraud rates in APAC are among the highest globally, with specific threats varying by market. For example, high fraud rates in Indonesia, the Philippines, and Vietnam require adaptive, AI-driven monitoring.

- Does the MoR offer real-time fraud detection and local risk intelligence?

- Can it mitigate chargebacks and prevent losses from emerging regional fraud trends?

- Coda’s Strength: AI-powered fraud prevention provides real-time risk assessments and reduces chargebacks.

Fast, Scalable Pay-ins & Payouts

Prompt payouts are critical for influencers, content creators, and business partners. Speed and flexibility in disbursements can enhance partner relationships and market competitiveness.

- Can the MoR facilitate pay-ins, top-ups, and instant payouts via e-wallets, bank accounts, and other preferred methods?

- Does the solution scale globally to support LATAM, EMEA, and beyond?

- Coda’s Strength: Instant pay-ins and payouts to digital wallets and scalable MoR infrastructure.

Ultimately, choosing an MoR for APAC is about more than processing payments—it’s about finding a partner who understands the region’s complexities and can help you navigate them with ease.

Coda’s solutions are designed to support your growth at every stage, from seamless payment integrations to robust compliance and fraud protection.

Final Thoughts: Why a Merchant of Record is Essential for APAC Growth

Expanding into APAC presents immense opportunities – but also unique operational challenges.

From navigating fragmented payment ecosystems to ensuring tax compliance and mitigating fraud risks, publishers need more than just a payment processor.

An MoR streamlines these complexities, enabling you to focus on what matters most: delivering outstanding gaming experiences.

Why Grow with Coda?

Coda as your Merchant of Record means you’re equipped with:

- Comprehensive payment integrations: Support for e-wallets, carrier billing, and bank transfers across APAC’s key markets.

- Full compliance coverage: Automated tax remittance and local regulation adherence keep you ahead of evolving policies.

- Advanced fraud prevention: AI-driven systems protect revenue and reduce chargebacks.

- Fast, scalable pay-ins and payouts: Empower partners and creators with flexible, instant payment solutions.

Expanding in APAC doesn’t have to be complicated. With Coda’s proven solutions, you can scale smarter, grow faster, and stay fully compliant – without the operational headaches.

Let’s put APAC to work for you. Connect with us today–and expand with confidence. If you’re ready to go, we’re ready to grow.

© 2026 Coda Payments Pte. Ltd

Site Credits