Navigating Global Digital Payment Challenges with Merchant of Record

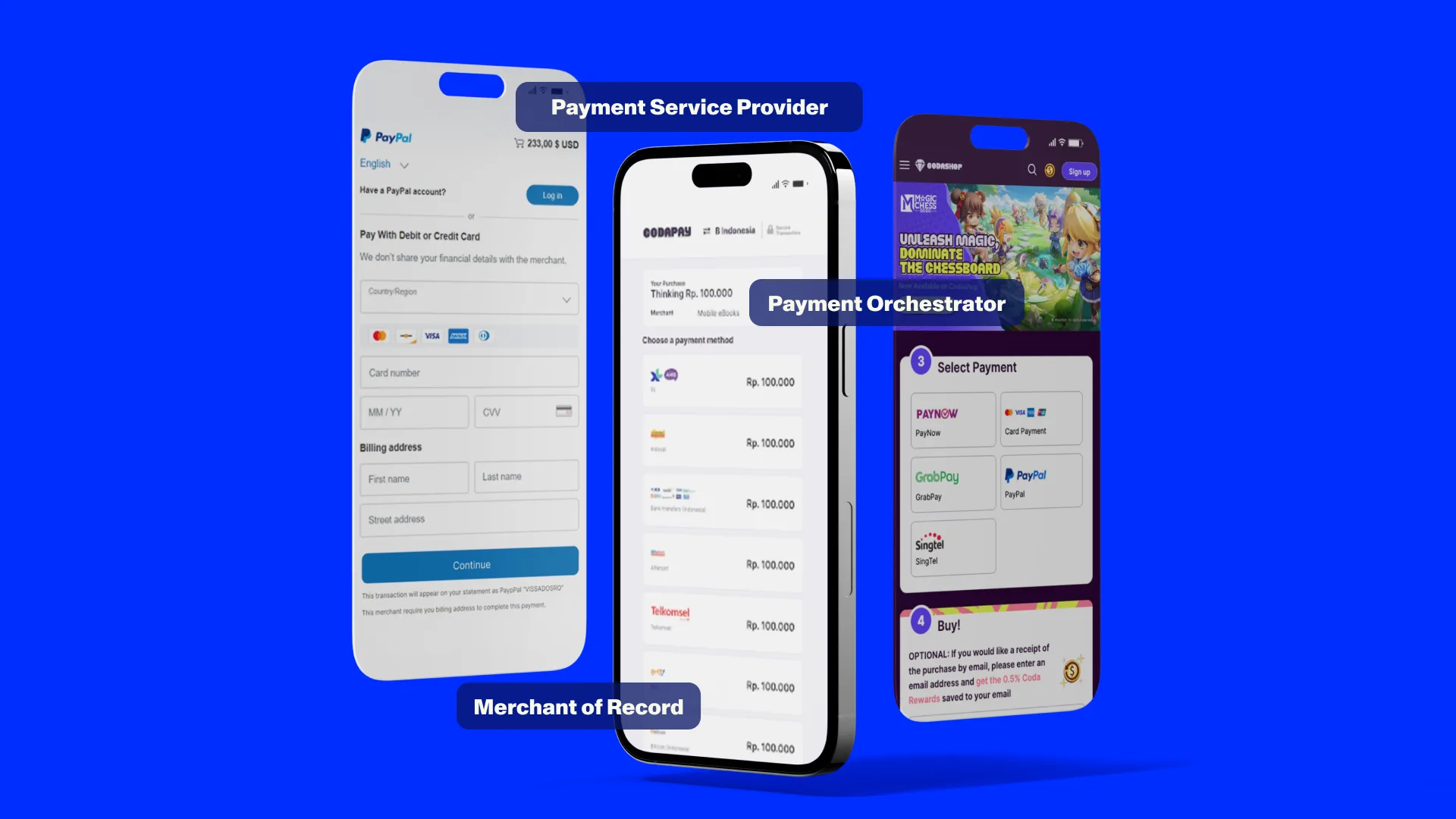

In digital content and gaming, payments aren’t just backend infrastructure—they’re central to growth, engagement, and retention. For mobile game publishers and streaming platforms alike, expanding into new markets means navigating payments at scale. But with scale comes complexity.

Let’s explore the major payment challenges faced by digital publishers today — fraud, underperforming success rates, and compliance headaches — and how Coda helps publishers overcome them with precision and scale.

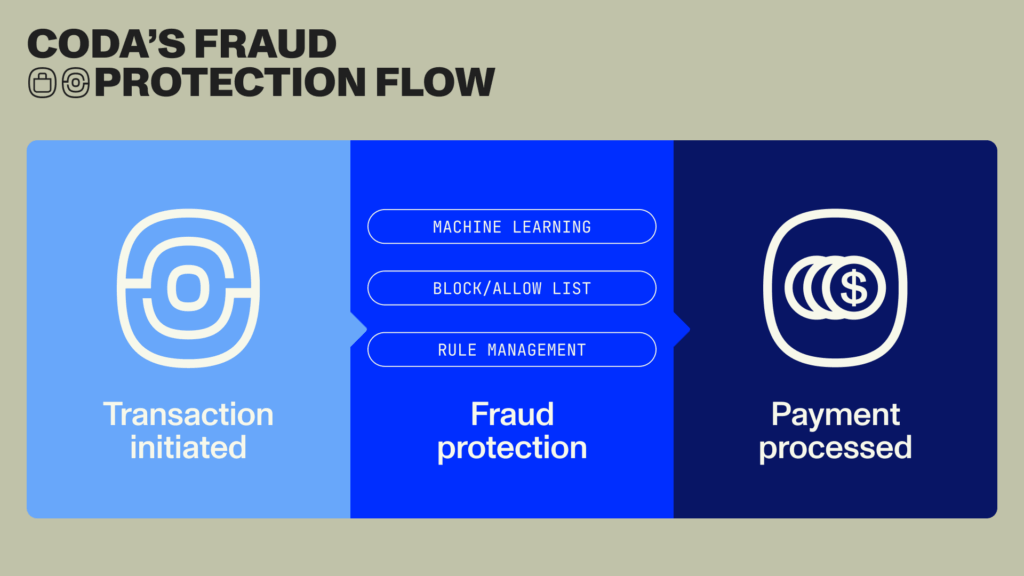

Fraud: The Silent Profit Killer

The Challenge:

Fraud remains a constant and evolving challenge in digital payments. From account takeovers and fake refunds to promo abuse and chargebacks, fraud not only erodes revenue but can also damage brand trust and increase costs due to penalties and investigation overhead.

How Coda Helps:

Coda’s fraud prevention system is purpose-built for the unique risks of digital content monetization. With machine learning models trained on millions of transactions across 70+ markets, we proactively detect and stop suspicious behavior in real-time. Key capabilities include:

- Behavioral pattern analysis to identify anomalies (e.g., sudden IP changes, device switching, or unusual volume spikes)

- Geo-risk mapping that adjusts risk thresholds based on region and channel

- Adaptive 3DS enforcement and custom velocity checks to prevent abuse while preserving frictionless payments for good users

Coda’s fraud operations team works closely with publishers to customize policies by product and region—protecting revenue while maintaining a smooth user experience.

Underperforming Success Rates: A Growth Bottleneck

The Challenge:

High payment failure rates cut into revenue—often without being noticed. This is especially true in emerging markets, where inconsistent infrastructure can lead to failed transactions. Issues like poor UX, processor downtime, local bank errors, or technical mismatches all reduce success rates and impact both growth and user experience.

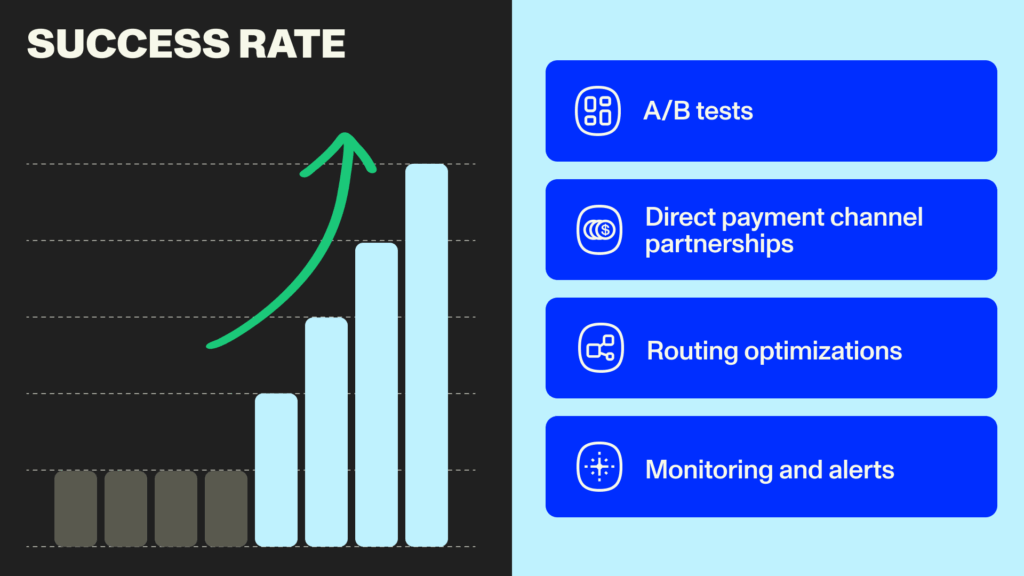

Our payments platform is built to maximize transaction success across 90% of the world’s most-used payment methods—from cards and e-wallets to carrier billing, cash payments, and local bank transfers. Our approach includes:

- Data driven optimizations: We don’t believe in guesswork. Every change at Codapay is tested, measured, and validated. From small UI tweaks to provider switches–we continuously A/B test, analyze impact, and scale what works.

- Direct payment channel partnerships: Our team works hand-in-hand with APMs, acquirers, and issuers to investigate failures, share learnings, and align on performance goals. Leading to streamlined payment experiences (for example, with optimized OTP and 3DS steps) that convert without compromising on risk protection & compliance.

- Redundancy by design: Coda partners with multiple PSPs and aggregators in nearly all regions to avoid single points of failure.

- Proactive monitoring & alerts: Our ops team continuously tracks payment KPIs by market and intervenes immediately when anomalies occur.

The result? Publishers on Coda’s platform frequently see 5–10% improvements in payment success in their toughest markets.

Compliance: Navigating Global Regulation with Confidence in Coda as Merchant of Record

The Challenge:

The compliance landscape for digital payments is constantly evolving. From tax documentation and local invoicing requirements to consumer data laws and financial disclosures, publishers must juggle dozens of regulations — and missteps can trigger audits, fines, or service disruptions.

How Coda Helps:

Coda is built for global compliance. As your Merchant of Record, we enable smooth expansion and operation across borders without the delays or uncertainty of navigating complex legal requirements.

Key features include:

- Built-in tax compliance management (e.g., VAT, GST, WHT) tailored to local markets

- Automated invoicing aligned with jurisdiction-specific formats and rules for select markets

- Regulatory reporting frameworks for LATAM, SEA, MENA, and more

- Audit trails and retention policies to support local legal requirements

Our legal and payments experts monitor changes in regional regulations and update our systems accordingly — so you stay compliant as regulations evolve—without adding to your workload.

Reporting: Eliminating Operational Blind Spots

The Challenge:

Inconsistent or delayed reporting slows decision-making and increases manual work. Operating across regions, providers, and payment methods often means piecing together data from multiple sources. Without detailed insights, it’s harder to spot performance issues or detect fraud early

How Coda Helps:

Coda’s reporting tools bring clarity to complexity. Our real-time dashboard provides a unified view of transactions across all markets and methods — down to the transaction ID.

Our reporting solution includes:

- Consolidated dashboards with drill-down filters by country, currency, product, and method

- Automated reconciliation files matched against settlements and payout reports

- Transaction-level visibility, including applicable local taxes and processing fees for customer support, finance, and business intelligence.

- Exportable reports and APIs to feed into your own analytics pipelines

Eliminate manual exports and time zone mismatches with real-time, actionable reporting you can rely on.

Why Publishers Choose Coda

Coda isn’t just a payments provider — we’re a monetization partner trusted by some of the world’s top digital publishers. Our solution brings together global reach, local expertise, and hands-on support—so your team can focus on growth and avoid the nitty gritty.

Here’s how Coda has publishers covered:

Conclusion

In the digital economy, effective monetization depends on getting payments right— where Coda rightfully delivers. By solving for fraud, underperformance, and compliance at scale, we empower publishers to unlock revenue with confidence.

Ready to go beyond payments and accelerate monetization? Let’s talk.

© 2026 Coda Payments Pte. Ltd

Site Credits